Italy | Another Year of Growth for Italian Crowd-Investing in 2022

The Observatory

Italy’s Crowd-investing industry is in good health. Compared to a year ago, funding in the Italian crowd-investing industry is up 27 percent with flows of €430.6 million – the industry proves to be an excellent opportunity for companies who want to finance themselves and for investors hunting for returns.

Since 2014, Italy’s 90 active platforms mark total inflows exceeding 1 billion euros. In particular, 129 equity crowdfunding projects focused on ESG criteria have raised 58.26 million euros.

The seventh Italian report on Crowd-investing, published by the Observatory of the School of Management of the Politecnico di Milano, analyzed the industry’s performance during the last twelve months (from June 2021 to June 2022). The report analyzed findings on the subset of crowdfunding that allows individuals and institutional and professional investors to directly join, through an enabling Internet platform, an appeal to raise resources for an entrepreneurial project, either by granting a loan (lending-based crowdfunding) or by underwriting shares of the company’s venture capital (equity-based crowdfunding).

“The analysis focused on two different classes of portals,” says Professor Giancarlo Giudici, who published the report with his team, “…Those for online funding authorized by CONSOB* to place venture capital shares of SMEs, mini-bonds and shares in OICRs* that invest in SMEs, and those for social lending, which convey loans from individuals to individuals or legal entities, distinguished into ‘Crowd’ and ‘Non-crowd’ portals (if they do not raise resources online from retail investors).”

*CONSOB: National Commission for Companies and Stock Exchange in Italy

*OICRs: Collective Investment Funds for Savings in Italy

The European Regulation

By November 2023, already operational European platforms must comply with the procedures set out in the new European Crowdfunding Service Providers (ECSP) Regulation, so as to make the rules more uniform among equity and lending portals and encourage cross-border operations.

“In Italy, we have witnessed a lively debate on the delay in defining some important points, including the competencies between CONSOB and the Bank of Italy,” Giudici underlines. “We hope that in November we will proceed without delay to define everything that is needed to give certainty to Italian operators and put them in a position to compete with European peers, as is in the spirit of the ECSP Regulation.”

Where the collection is going

Annual fundraising for equity crowdfunding was 97.79 million euros for non-real estate projects (with some decline in the first half of 2022), to which 44.10 million for real estate projects should be added. Mini-bonds placed on portals increased to 37.63 million euros: this segment did not exist until the first half of 2020 and grew by 68.7 percent. Lending portals contribute in the last year with 65.49 million euros lent to individuals (+51.7% despite the few active platforms) and 102.44 million to businesses through generalist portals (down in H1 2022), plus 83.15 million from portals specializing in real estate, on the contrary increasing well in the last 6 months (+56.7%) thanks to the proliferation of portals.

Real estate is the fastest-growing segment: there are now 27 dedicated platforms and they have raised as much as 127.25 million euros in 12 months, +38.1% compared to the previous period. In equity crowdfunding as of June 30, 2022 there were 51 portals authorized by CONSOB to raise capital online, exactly the same as last year. In the past 12 months, 36 mini-bond placement campaigns were completed on the 8 portals currently authorized, totaling 37.63 million euros.

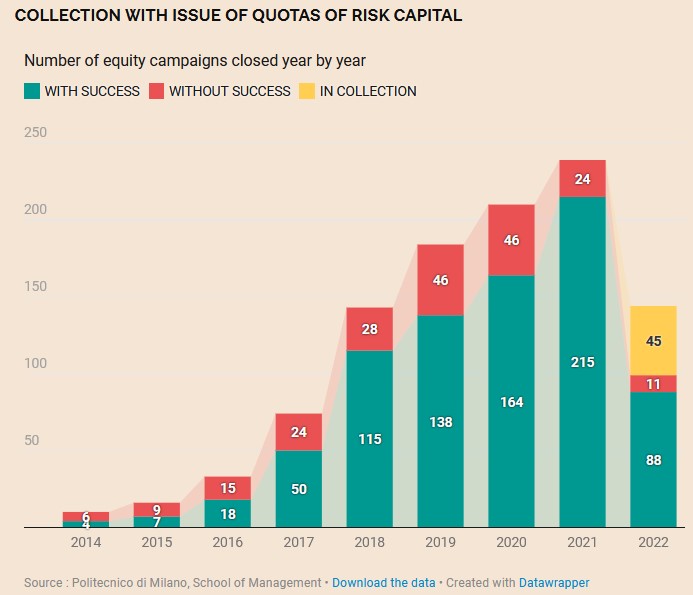

The success rate continues to remain high: in the first 6 months of 2022 it is 88.9 percent, well above the overall average for the entire sample since 2014 of 79.3 percent. Cumulative venture capital funding over time is 429.04 million, and in the last 12 months the flow was 141.9 million, including 58.99 million in the first half of 2022. The average value of the raising target for non-real estate projects is 204,762 euros, for real estate projects it is 1,078,633 euros.

Number of equity campaigns closed by year – Italy

The size of the market then grows significantly if one also considers the contribution of FinTech portals that provide loans to individuals and businesses but do not collect from small Internet savers: the 3 platforms Younited Credit, Credimi, and Opyn have disbursed nearly 4 billion euros in recent years, demonstrating the need to also involve professional funds and investors if one wants to scale financing significantly.

Among issuers, SMEs continue to gain space, but the market is still dominated in particular by innovative startups (56 percent of cases in the last year, joined by 16 percent of innovative SMEs). The vast majority operate in Lombardy, then Emilia Romagna and Lazio, and are active in the information and communication services sector.

Lending-based crowdfunding

As far as lending is concerned, 39 platforms were active in Italy as of June 30, 2022 (7 platforms to finance individuals, 12 dedicated to businesses and as many as 20 specialized in real estate). Funding in the last 12 months was €65.49 million for consumer platforms, with a cumulative total over time of €188.82 million: leading the way is Soisy, with €43.26 million in the last year.

The generalist platforms in the business segment add 102.44 million euros to their assets, reaching a cumulative total of 272.97 million: October excels in the segment with 83.20 million euros raised, of which, however, a good portion comes from professional non-crowd investors. Real estate platforms record an annual flow of 83.15 million euros raised and total 176.49 million: the first is Rendimento Etico, with 24.3 million euros in assets in the last year. Some platforms provide protection funds to repay any defaulted loans, while others leverage the public guarantee of the State SME Fund.

Read the original report article: 24 Finanza Personale